Services

Services we provide

Wealth Management

Wealth Management encompasses all areas of your financial life. We focus on your complete financial situation and offer tools to help you achieve financial independence. We employ a series of steps in helping you reach your financial dreams, and the cycle continues as we provide long term support for your financial goal.

We start by taking a fresh, close look at your current financial situation. Together we gather information and examine you’re:

- Assets (and their fair market value)

- Liabilities

- Monthly Cash Expenditures

- Income Tax Situation

- Wills and Trusts

- Insurance Contracts

- Retirement assets

Gathering facts about these and other aspects of your current financial situation gives us and you a clear starting point on the road toward helping you meet your financial objectives. A thorough discussion will reveal any immediate actions that may be necessary before proceeding with our analysis.

Once we have a clear understanding, together we determine what your financial goals and objectives are. We never assume your objectives are the same as those of any other person. We want to hear about what you desire and what you will need in the future.

We review your expectations with you and discuss their relationship with what we already know about you. Once again, our knowledge of economic trends helps us to develop tactics that are realistic. We have listed the types of objectives you may wish to take into consideration:

- Investment Planning

- Determining Investment Temperament & Risk Tolerance

- Setting Investment Goals

- Selecting Investment Variables

- Monitoring Investment Portfolio

- Retirement Planning

- Targeting Retirement Age

- Retirement Plan Selection and Design

- Targeting Income Needs at Retirement

- Distribution Alternatives & IRA Roll Over Options

- Cash Flow Analysis

- Identifying Income Sources

- Projecting Living Expenses

- Implementing Methods to Improve Cash Flow

- Income Tax Planning

- Methods of Reducing Tax

- Tax Deferral Techniques

- Insurance Planning

- Determining Life Insurance Needs

- Determining Disability Insurance Needs

- Determining Long Term Care Insurance Needs

- Selecting Insurance Products

- Business Planning

- Selecting a Business Entity

- Techniques for Transferring Ownership

- Education Planning

- Targeting Cash Needs for Education

- Selecting Methods for Funding Education

Once the objectives have been identified, we begin the process of analyzing your financial information to develop a strategy for your individual financial plan. We pay particular attention to those areas of your plan of utmost importance to you.

Upon completion of analysis, we can provide an outline of an overall strategy. With our previous experience and training, as well as the new information we are constantly receiving, we will be able to carefully design the right plan for your needs and desires. All of the input you provide us ensures your plan will be uniquely fitted to the attainment of your particular goals. Once we have laid out a strategy, we again consult you to make sure we haven’t missed anything. This ensures that you thoroughly understand every aspect of the strategy. We take time to answer all of your questions before we take another step.

The best plan is worthless without proper implementation so in this critical step we walk with you to put the plan in action. We will bring the strategy to life with your help and strive to make your financial objectives a reality.

The wealth management process does not end with the implementation of the plan. We continue to monitor the progress, and as your circumstances and desires change, we update and improve the initial plan. We invite your questions and can assist with day-to-day financial decisions.

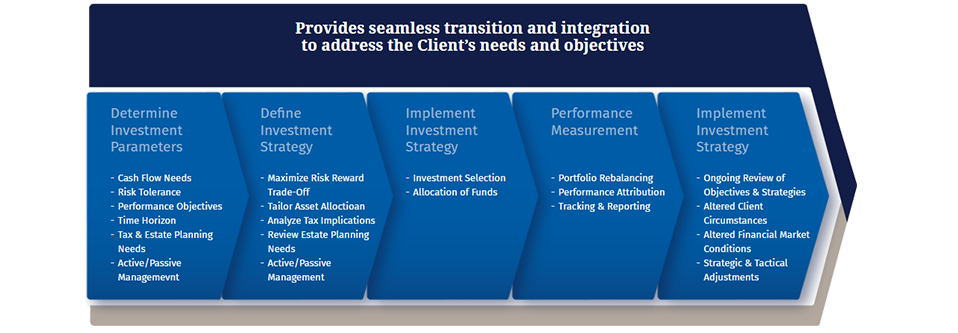

Investment Management

Through our Portfolio Management process, we provide a seamless transition and integration to address your needs and objectives. Through this detailed process we analyze many aspects of your financial life and use our portfolio construction methodology to create an investment strategy to meet your goals. We guide you through this process with the goal of creating a comprehensive portfolio strategy for your unique financial situation.